PSLF Employment Certification Form Fedloan – It is used by a PSLF to declare any payments you make to the Social Security Administration or the IRS to cover the costs of pensions and other benefits. It’s easy to fill in and can help you save time as well as cash. The form contains several sections, including Employer information, Payments that count toward PSLF, and recertifying employment.

PSLF-compliant payments

PSLF will take into account any payment that is made, even those from federal student loan repayment plans. You must have received minimum 120 qualifying payment within the last ten years to be eligible to participate in this program. You can set up automatic debits to make sure you have made the qualifying payments.

PSLF was previously required to have the appropriate kind of repayment and the right amount. However the federal government has recently extended the eligibility requirements for the program and began accepting late payments starting in 2007. PSLF now accepts loans of all types and repayment terms. MEA UniServ Director Jon Toppen leads trainings for MEA members on how they can qualify for PSLF.

If you have been granted a deferment to the Economic Hardship Deferment, the PSLF is also available. If you were granted the loans prior to January 1st, 2013, your they will count towards PSLF. In the past, only payments on federal student loans under the Federal Family Education Loan program could count towards PSLF.

PSLF is technically accessible to Direct Parent Plus Loans as provided that the parent has an occupation that is qualified. The parent will not be eligible for PSLF in the event that the Direct Parent Plus Loan is not converted into a Federal Direct Consolidation Loan.

Recertification of employment

It is crucial to certify employment in the PSLF application form to be eligible for the PSLF loan cancellation program. The program requires that borrowers are employed by a public agency or a non-profit organization for at least a years for them to be eligible. They also must make 120 qualified loan payments over this time. The process of recertifying employment on the PSLF form involves submitting it to MOHELA who will then review it and let the borrower know how many qualifying loan repayments they’ve made.

The PSLF form must be submitted every year or when you make a change in your job. This will verify your eligibility to the program. The loan will be automatically transferred to MOHELA, which is the agency that oversees the program. Once you’ve filled out the application, you must submit any documentation to show that you’re still working.

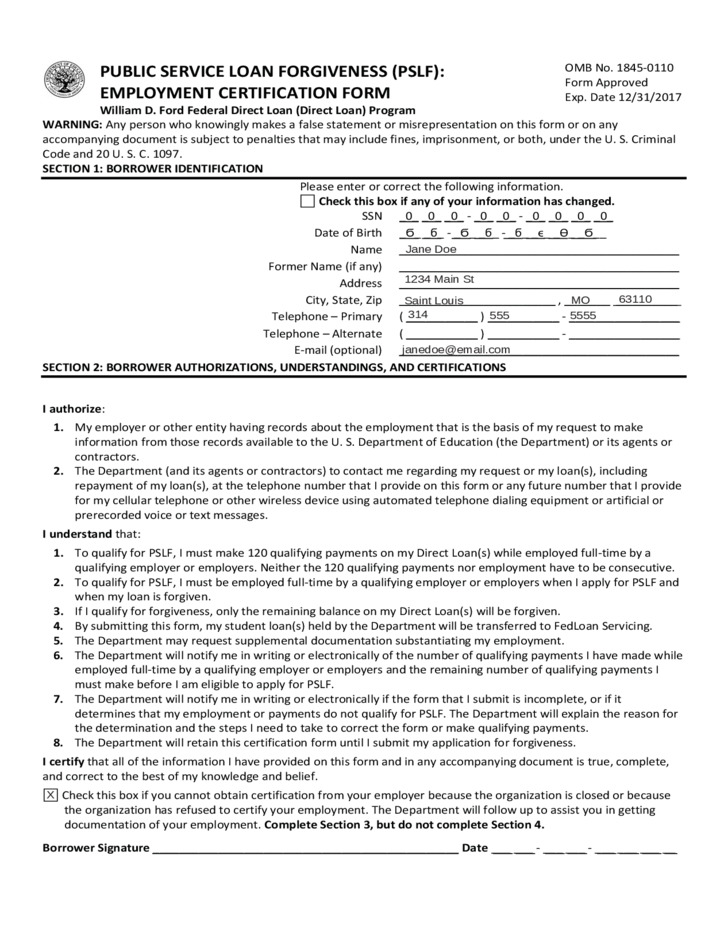

In order to complete the PSLF employment certificate form, you’ll be asked to provide personal information such as your name, Social Security number and the date of birth. In order to confirm any changes to your information the form requires you to tick a checkbox. After you have completed the form, you will be required to verify the accuracy of the information by selecting a checkbox. The PSLF Employment Certification Form must be signed and dated by you. The form will be addressed directly to the Department of Education.

Recertify your employment status using the PSLF form, if you are employed in a qualified public service or agency. This form could impact your PSLF payments as well as late partial payments and lump sum payments. To be eligible to receive PSLF, you must submit the PSLF form before the due date regardless of whether you are employed in the public or private sector.